Medigap, more commonly known as a Medicare Supplement, helps to cover the gaps in Original Medicare. After Medicare pays their agreed portion, the Medigap (Medicare Supplement) will step in to pay certain out-of-pocket expenses.

Original Medicare is a public fee-for-service health plan that comes in two different parts: Part A and Part B. Medicare Part A covers costs like hospital stays, skilled nursing facilities, hospice care and more. We like to think of Medicare Part A as the “room and board” of Medicare. There is a deductible associated Medicare Part A, for the year 2023, it is $1,600 per benefit period. A benefit period is every 60 days you spend un-hospitalized. Medicare Part A will cover your first 60 days spent in the hospital, after those 60 days have passed, you will incur a co-pay of $400 per day spent in the hospital for the year 2023. Part A will also cover skilled nursing facilities for up to 20 days, after those 20 days, you will be liable for $200 per day spent in the skilled nursing facility. After 100 days, you will be liable for all costs.

Medicare Part B is designed to cover all medical expenses that are done in an out-patient basis. We classify Part B as the “medical insurance” part of Medicare. Part B will cover things like doctor’s visits, ambulance rides, emergency room visits and durable medical equipment. When dealing with Part B, there are three main costs that can be incurred: the Part B Deductible, Part B Co-Insurance, and Part B Excess Charge.

- The Part B Deductible for the year 2023 is $226. This is the amount the member will have to pay before we move to the next stage, which is co-insurance.

- The Part B Co-Insurance, also known as the 20/80 Rule. After the Part B deductible has been met, Medicare Beneficiaries are responsible for 20% of covered services for the remainder of the calendar year, where Medicare will take care of the 80%.

- For Part B excess charge, providers can charge 15% more than the Medicare approved amount, if that provider does not accept Medicare assignment.

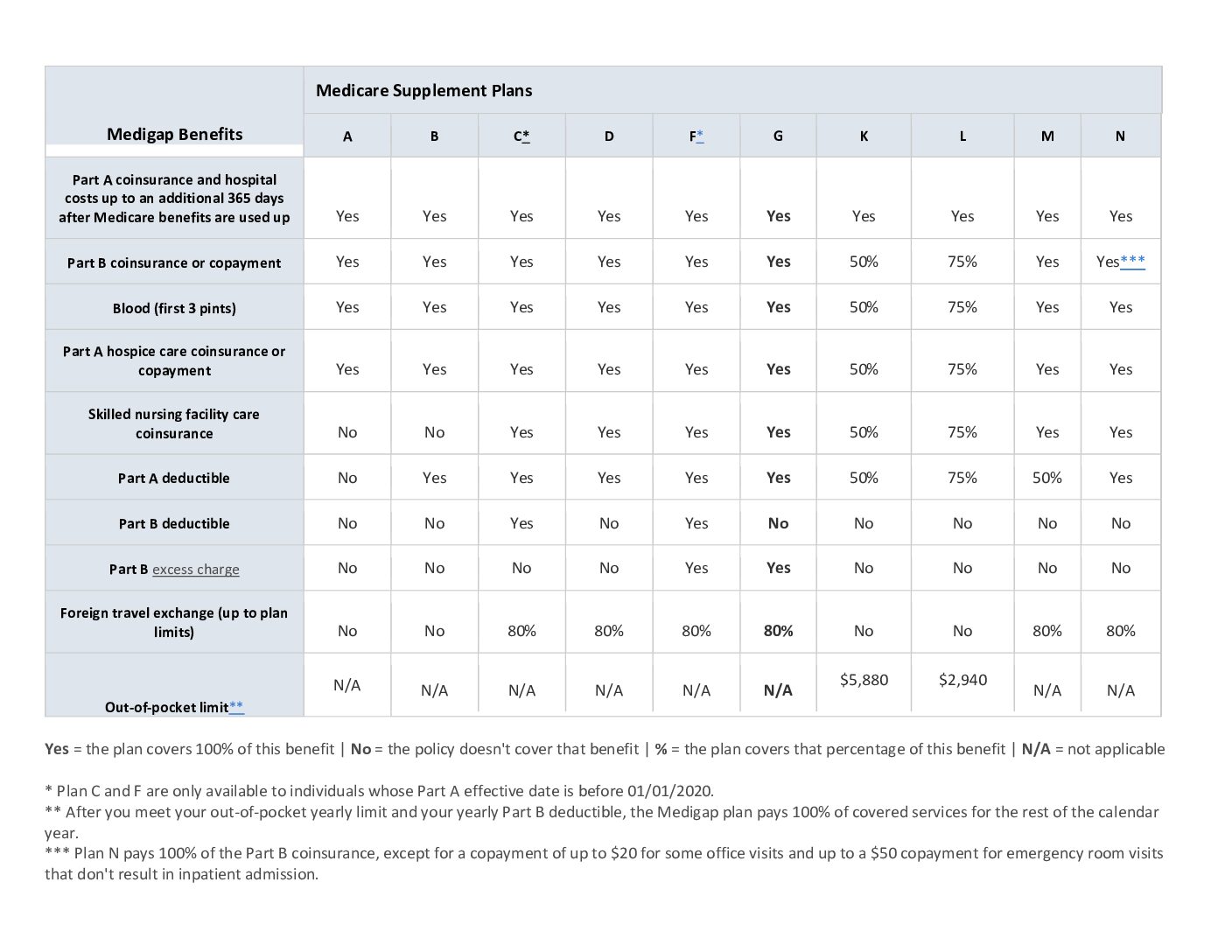

Medigap, or Medicare Supplement, steps in and covers most, if not all Medicare approved expenses that are to be paid by the Medicare beneficiary. There are ten main Medicare Supplement policies that are offered, these policies are all standardized by the government. However, there are three main Medicare Supplement policies that are more commonly sought out and purchased, these policies are Plan F, Plan G, and Plan N.

We like to start with Plan F as it is the easiest to understand. In essence, with a Plan F, you will pay a premium to a private insurance company in exchange for them to pay your backend Medicare costs; the Part A deductible, Part B deductible, Part B co-insurance and Part B excess charge. To qualify for a Plan F, your Part A effective date must be prior to January 1st, 2020.

In recent years, the Plan G has become more popular, as individuals that become eligible for Medicare after January 1st, 2020 can still acquire this plan. Plan G works very similarly to the Plan F, except it does not cover the Part B deductible. The Part B deductible for the year 2023, is $226 per calendar year.

The third Medicare Supplement policy that is commonly discussed is the Plan N. Plan N is similar to Plan G, where it will pay all expenses aside from the Part B deductible. However, Plan N does not cover the Part B excess charge like Plan G.

Although these plans are all standardized by the federal government, private insurance companies can charge different amounts for their Plans F, G, and N. It is important to review your individual situation to decide which plan is best suitable for you and your needs.