I’m going to have to pay what for my Medicare premiums?! If these words have ran through your head when you got your first Medicare bill, this article is for you! When it comes to Medicare premiums, you may have to pay more than the standard premiums. These are called Income Related Monthly Adjusted Amounts, also known as IRMAA’s. Medicare beneficiaries with higher income amounts may pay more for Part B and Part D premiums.

IRMAA goes off the Modified Adjusted Gross Income, or MAGI. MAGI is the households adjusted gross income after any tax-exempt interest income and after factoring in certain tax deductions, this is Line 11 of the IRS form 1040. Your IRMAA is based off your income from two years prior. For example, your Medicare premiums for 2023 will be computed based off of your 2021 tax return. If you were a high-income earner, you may be paying more. It is important to note, if you file your tax return jointly, you and your spouse will be paying the IRMAA amount!

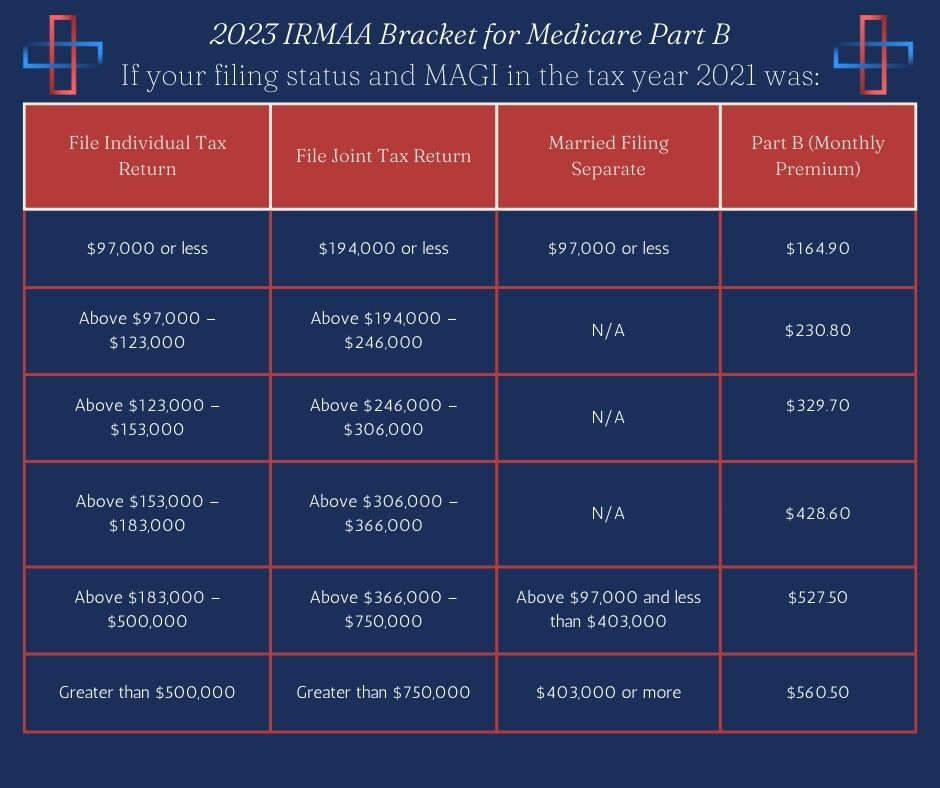

The IRMAA for Part B is an additional charge to your Part B Premium. If you are receiving Social Security Benefits, your Part B Premiums will be deducted from your Social Security check. If you are NOT receiving Social Security benefits, you will pay your Part B premium along with your Part B IRMAA directly to the Social Security Administration. In the graphic below, you will see the Part B IRMAA brackets for 2023 based off your 2021 MAGI.

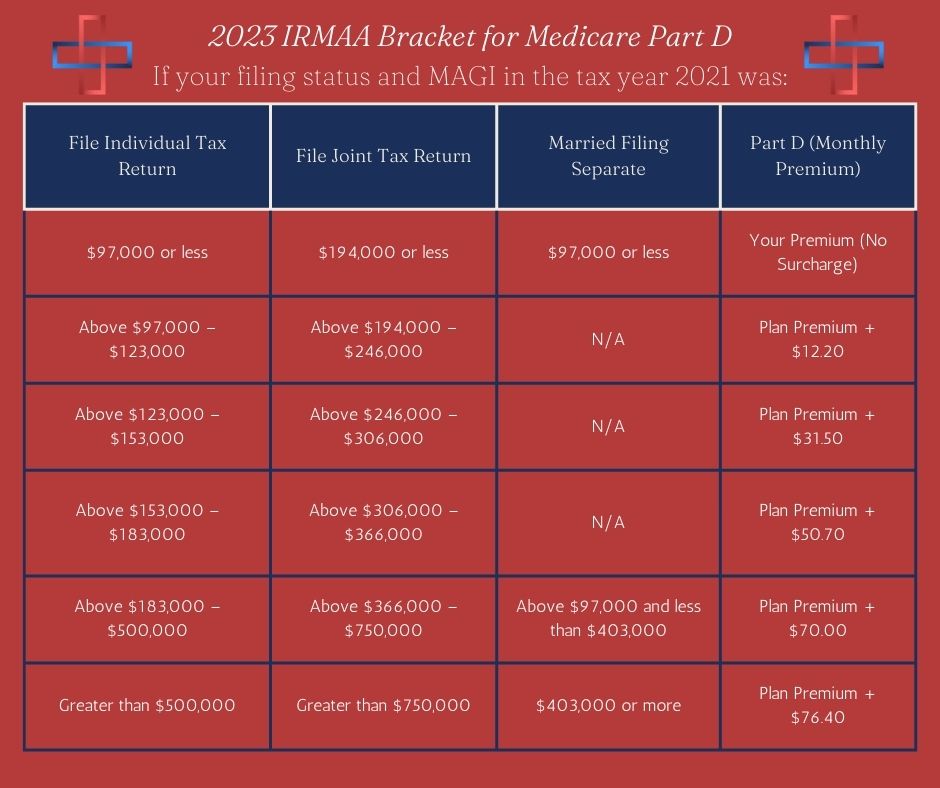

Your Part D IRMAA is your plan premium plus an additional amount that is paid to the Social Security Administration and not the plan carrier. Again, if you are receiving Social Security benefits, your Part D Premiums will be deducted from your Social Security check. If you are not receiving Social Security benefits, you will pay your premiums directly to the Social Security Administration along with your Part D IRMAA. In the graphic below, you will see the brackets for your Part D IRMAA for 2023 based off your 2021 MAGI.

If you experienced a year of higher income, but it has decreased since then, there is a form that can be completed to help avoid paying more for your Medicare benefits. Social Security has a form called the SSA-44, also called a Medicare Income Related Monthly Adjusted Amount Life Changing Event Form. You would complete this form to verify that a year of high income that has decreased the next year. It is important that you include all the various documents proving your incomes when you mail in this form. For the quickest response, mail the SSA-44 form into your local Social Security office. You will hear back from the Social Security office in 8 weeks.

There are a couple misconceptions when it comes to IRMAA. Many believe there is a Part A IRMAA, however, there actually is no Part A IRMAA. Another common misconception is that IRMAA is based off the year you take Medicare, this is not true. As stated above, IRMAA is based off your income from two years prior.

It is very important that when we are planning to start our Medicare benefits, we have our financial house in order. Whether we are a small business owner or a high-income earner, we must know how our income streams are going to affect what we pay in premiums. We also recommend talking with a tax professional to understand what our income was two years prior. If we are going to make more money in the coming years, we may want to think about some strategies to reduce our income. Some common strategies include contributing towards retirement accounts, making charitable donations, or if you are a business owner, finding other tax deductions through your business could help you reduce your income.